Source: SmartCompany

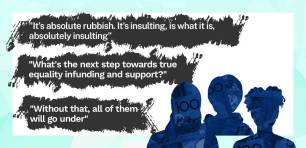

Accountants and bookkeepers have welcomed a last-minute reprieve from eight new obligations scheduled to begin in August, but feel more should be done to shield small practices from further ‘red tape’.

A legislative instrument signed by Assistant Treasurer Stephen Jones, containing eight new obligations for tax practitioners on top of the existing Code of Professional Conduct, came into effect on Thursday.

The Assistant Treasurer says all eight obligations were shared with industry practitioners in a draft consultation period, and that a transitional period was always built into the rule change.

Nevertheless, the directive — revealed just weeks before the rules came into effect — appeared to surprise accountants and bookkeepers already dealing with the tax-time rush.

Handpicked for you

Frankly Speaking: Three lessons I’ve learnt from the first year of running my small business

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.