Mega fines, ending retribution: What a mandatory Food and Grocery Code of Conduct means for SMEs

Major supermarkets will be banned from taking retribution against their small business suppliers and could find themselves subject to massive fines, after the federal government agreed to make the Food & Grocery Code of Conduct mandatory for the industry's biggest players.

NSW Budget: $325 energy rebates for SMEs during cost-of-doing-business crisis

The 2024-2025 NSW budget pledges to pass on the energy bill rebate promised in this year's federal budget without extra rebates for SMEs.

Exclusive: Small Business Minister shies away from permanent $20,000 instant asset write-off, for now

Minister for Small Business Julie Collins has shied away from permanent changes to the instant asset write-off scheme, as small businesses endure another anxious wait for the cashflow-boosting measure to become law.

Queensland budget: $650 SME energy bill relief, vehicle rego cuts and cybersecurity support on the books

Small businesses in Queensland will receive another $650 in energy bill rebates from July 1, with joint funding provided by both state and Commonwealth governments.

Parliament has only four days to pass the instant asset write-off before July 1

Australian lawmakers have just four sitting days to legislate the instant asset write-off extension promised to small businesses for the 2023-2024 financial year, giving entrepreneurs precious little time to organise their tax affairs ahead of July 1.

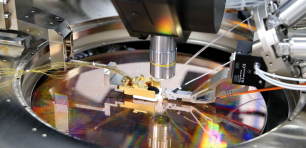

PsiQuantum deal under microscope: Senate estimates raise more concerns

A Senate estimates hearing has intensified scrutiny over the $1 billion PsiQuantum investment, questioning the government's due diligence process.

“Nasty negativity”: Chalmers slams opposition over $20,000 instant asset write-off delay

Treasurer Jim Chalmers has blasted the federal opposition for allegedly holding up the passing of the $20,000 instant asset write-off scheme.

“Get on the side of small business”: Independent MP Zali Steggall blasts instant asset write-off delay

Warringah MP Zali Steggall has urged the government to support the amendment to the instant asset write-off legislation and deliver on its promises for small business.

Peter “I’ve run a small business” Dutton delivers budget reply

The Opposition leader promised to increase the instant asset write-off threshold to $30,000 and make the measure permanent for small business.

WA posts sixth consecutive surplus budget with $400 energy credit for SMEs

WA Treasurer Rita Saffioti's first budget delivered a $3.2 billion windfall for the current financial year, with a further $2.6 billion surplus projected for 2024-25.

Victoria’s $246 million sick leave for casuals trial to end ahead of schedule

A $245.7 million pilot program providing sick leave for Victorian casual workers will end a year ahead of schedule, as businesses wait to hear if they will be asked to foot the bill going forward.

Victorian budget: Payroll tax threshold to lift to $900,000 on July 1

The Victorian government has re-announced upcoming changes to payroll tax for the state's businesses, with the first of two increases to the payroll tax-free threshold due to take effect on July 1 this year.