Why ESG reporting at the end of the financial year is more than a nice-to-have

As we approach the EOFY, it's time for SMEs to turn their attention to their Environmental, Social, and Governance reporting in a real and measurable way.

Three things you’re doing wrong when presenting, and what to do instead

A well-prepared, engagingly delivered presentation will always resonate more deeply than one that is boringly read, memorised by rote, or waffled through via improvisation, explains Dr Louise Mahler.

Queensland budget: $650 SME energy bill relief, vehicle rego cuts and cybersecurity support on the books

Small businesses in Queensland will receive another $650 in energy bill rebates from July 1, with joint funding provided by both state and Commonwealth governments.

Parliament has only four days to pass the instant asset write-off before July 1

Australian lawmakers have just four sitting days to legislate the instant asset write-off extension promised to small businesses for the 2023-2024 financial year, giving entrepreneurs precious little time to organise their tax affairs ahead of July 1.

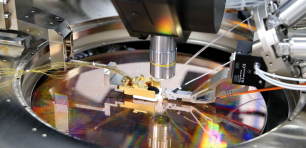

PsiQuantum deal under microscope: Senate estimates raise more concerns

A Senate estimates hearing has intensified scrutiny over the $1 billion PsiQuantum investment, questioning the government's due diligence process.

How to avoid the most costly mistake small businesses make at EOFY

While it may be tempting to claim deductions in the eleventh hour before EOFY, it’s wise to resist the allure of impulse purchases. Here are some tips to avoid this common mistake.

Uncertainty over instant asset write-off leaves SMEs and accountants in the lurch

As EOFY approaches, accountants are struggling to advise SMEs on the $20,000 instant asset write-off, which is stuck in legislative limbo.

NSW employers to face “significant maximum penalties” for industrial manslaughter

Law reforms to create an offence of industrial manslaughter in NSW will bring the state into line with other jurisdictions and see individual and corporate employers face up to 25 years in prison and fines of up to $20 million for worker deaths.

“Nasty negativity”: Chalmers slams opposition over $20,000 instant asset write-off delay

Treasurer Jim Chalmers has blasted the federal opposition for allegedly holding up the passing of the $20,000 instant asset write-off scheme.

“Get on the side of small business”: Independent MP Zali Steggall blasts instant asset write-off delay

Warringah MP Zali Steggall has urged the government to support the amendment to the instant asset write-off legislation and deliver on its promises for small business.

Four ways business leaders can bottle IKEA’s ‘secret sauce’

There are many companies that take interesting, modern, progressive approaches to respond and shape the industries they operate in. When futurist Steph Clarke sees an emerging challenge she often wonders: what will IKEA do?

Five smart moves for SMEs to maximise tax deductions this EOFY

Many business owners aren’t aware that deductions could make a significant difference to their tax refund, explains Leanne Berry of MYOB.